Inman | March 16, 2020 | Lillian Dickerson

Going remote isn't just a new trend in the standard workforce — it's also on the rise among real estate investors:

As new kinds of technologies have allowed greater connectivity, individuals can work from home more than ever before.

It’s not only the average office worker who’s working from home, though — over the past few years, remote buyers of real estate owned (REO) properties have gradually increased, and more remote-focused investment companies and increased technology are empowering individual investors to buy out-of-state.

REI Nation, a family-run investment property portfolio management company traditionally focused on passive investors, started assisting remote investors once the internet became more pervasive.

“We’ve always focused on working with passive investors,” Chris Clothier, co-owner of REI Nation, told Inman. “People who had the disposable income, but didn’t have the time. We really got into the remote investor around 2007 and it happened because really, with the internet, we were able to advertise our services to investors in other cities. We primarily started with investors out of California, New York and Florida — expensive states where there was a higher likelihood that people would have disposable income or wealth.”

Today, Clothier said his client base “almost exclusively” invests in remote real estate and has grown significantly since the company first began drawing remote investors. The company, which rebranded from “Memphis Invest” at the beginning of January, currently operates in Memphis, Tennessee; Little Rock, Arkansas; Tulsa and Oklahoma City, Oklahoma; St. Louis, Dallas and Houston, and plans to expand in two to four new Southeastern markets in 2020.

“Back in late 2008, ’09, ’10, we were doing anywhere from 200-300 transactions a year,” Clothier said. “And now we’re doing 1,000 transactions a year. A lot of it has to do with the way we operate as a company, but it’s also because of the ease and the ability to get started — the barrier of entry is really low. With the advent of the internet, there’s so much information out there — you can learn a lot, you can do a lot of due diligence, you can do a lot of oversight remotely.”

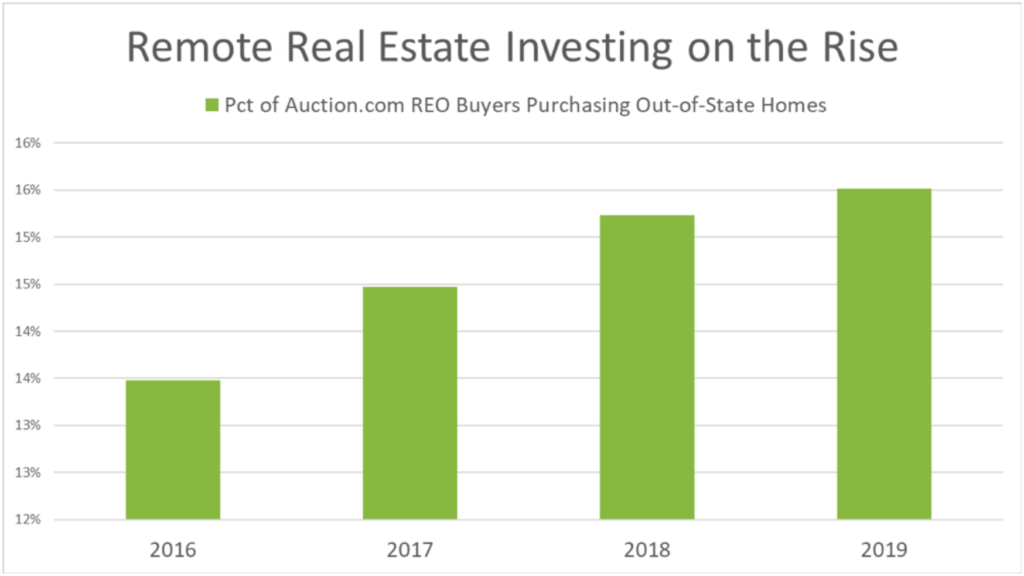

A real estate owned property is a foreclosed home that failed to find a buyer during auction and is now owned by the bank. According to a study by Auction.com, an online real estate transaction marketplace for sales of bank-owned and foreclosure properties, 16 percent of REO buyers using their platform in 2019 purchased out-of-state homes, an increase from 15 percent in 2018 and 13 percent in 2016.

Scott Stuber and Tyrone Velasquez, the married owners of Nuremberg Properties, started investing in properties outside of their home state of Colorado once the market started getting too pricey around 2016.

“We were actually flipping houses in Colorado — we had done some places in Florida — and when we had done our last one in Colorado, the market had changed and at that point, it had just gotten so expensive,” Stuber told Inman.

“Houses were priced at the top of the market and would still need a full rehab,” Stuber added. “When you do that, there’s very little room for profit … it was a risky move, so we started to look at other areas to possibly invest in.”

(HousingWire / Auction.com)

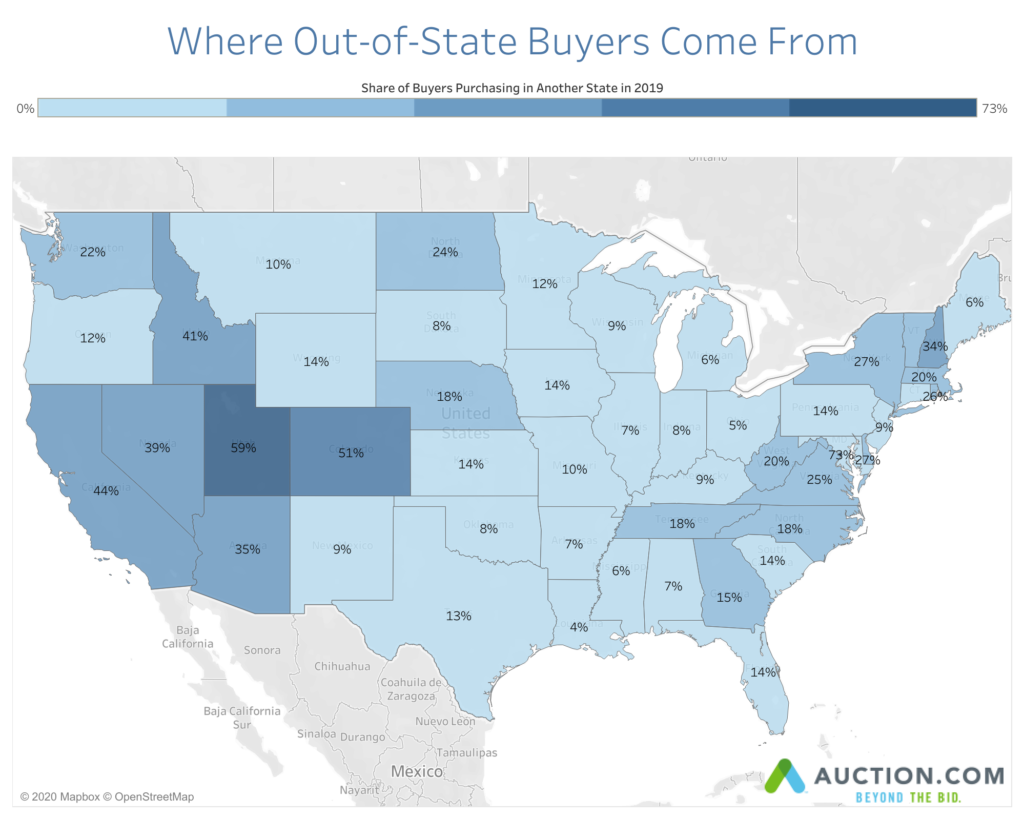

Stuber and Velasquez are just two of a steadily growing demographic of house flippers looking to purchase in markets far away from those they live in. The greatest concentration of buyers purchasing REO properties out-of-state in 2019 were located in the West: in Utah, 59 percent of buyers purchased out of state; in Colorado, 51 percent; in California, 44 percent; in Nevada, 39 percent, and 35 percent in Arizona.

(HousingWire / Auction.com)

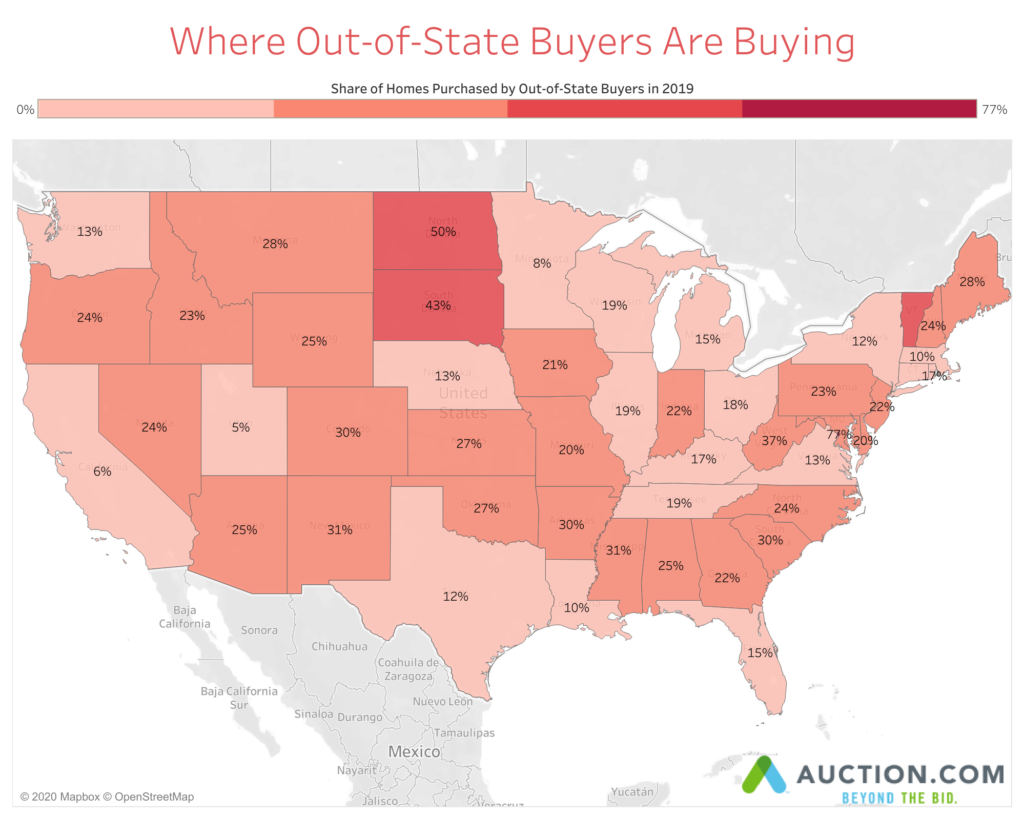

However, the majority of REO sellers who sold to buyers out-of-state during 2019 were in the Dakotas (50 percent in North, 43 percent in South) and the South: 37 percent of sellers in West Virginia sold to out-of-state last year; in Mississippi, 31 percent; and 30 percent in both South Carolina and Arkansas.

(HousingWire / Auction.com)

Stuber had lived in Ohio before, so he and Velasquez poked around different cities in the state before landing on Dayton.

“We started looking at Columbus and Cincinnati and Cleveland, and then I happened to come across a place in Dayton. We found a lot of affordable houses,” Stuber said.

During their first trip to Dayton, Stuber and Velasquez ended up buying three homes that went up for auction over the course of a month.

When looking at properties remotely, Stuber and Velasquez cross-compare information from resources like Auction.com, Zillow and Google Maps street view.

“We do use Auction.com a lot for property information, taxes, that kind of stuff. Auction.com is actually very good about thoroughly checking the figures,” Stuber said.

Although 19 percent of REO properties sold on Auction.com in 2019 were purchased by out-of-state buyers, most small investors and larger companies recommend having some sort of on-the-ground interaction in whatever market you’re buying.

“Too often investors buy solely on price,” Clothier said. “Who you work with is much, much, much more important than where you’re investing.”

“You have to be willing to put some time in, do the research and protect your investment,” he added.

“If you’re going to do this — a lot of people don’t understand this — it’s a lot of work, and you have to have a good team in place,” Stuber said. “If you don’t have a good team, you’re going to be sitting on a bunch of property. You’re going to be paying property taxes on properties that you’re not generating any income from.”

When Stuber and Velasquez first started working on properties in Dayton, they spent about 14 to 16 months living in Dayton while flipping properties and built up a team of contractors, electricians and other home renovation professionals they could count on.

“And that’s important if you’re going to invest remotely: build a good team,” Stuber emphasized.

Stuber and Velasquez also enlist the help of a local Dayton agent when they need someone on the ground to scope out properties for them.

“That’s another thing I always recommend — make friends with a real estate agent,” Stuber said. “It’s really a plus. We’ve bought four houses through him. And it’s an important step because they can also turn you on to some really good deals that you could miss otherwise.”

Inman | March 16, 2020